Connect with our Advisory leaders

Wade M. Kruse

National Managing Partner, Advisory Services

Grant Thornton LLC

Wade Kruse is the national managing partner for Advisory Services, where he is responsible for effective execution of the firm’s strategy within the Advisory service line and has direct oversight and responsibility for the service line's operations, financial performance and quality.

Atlanta, Georgia

Industries

- Healthcare

- Hospitality & Restaurants

- Manufacturing, Transportation & Distribution

- Private equity

- Services

- Construction & real estate

- Technology, media & telecommunications

Gerard Glynn

Executive summary

Jerry Glynn is a State and Local Tax practice managing director with 30-plus years of diversified SALT experience primarily focused in sales/use and income/franchise taxes. Jerry’s client service experience includes multi-state transactional advisory services, audit defense and appeals, tax overpayment reviews, sales and use tax compliance services, sales and use tax technology implementations, and diagnostic compliance review and remediation services. Jerry has served clients in various industry sectors including manufacturing, pharmaceutical, healthcare, energy, retailing and developing technologies. Jerry is also recognized as a firm subject matter expert on “Cloud” sales and use tax issues, having assisted various technology clients with categorizing their products, sourcing of sales and administration of applicable state and local taxes. Outside of his many years in public accounting, Jerry spent five years in the oil and gas industry at Sunoco’s tax department, primarily responsible for state and local income/franchise tax planning, controversy and compliance matters.

Professional qualifications and memberships

- Certified Public Accountant (PA)

- Active member of the AICPA and the Pennsylvania Institute of Certified Public Accountants of Certified Public Accountants

- PICPA Sales & Use Tax Thought Leadership Committee member

Education

- Masters of Taxation, Philadelphia University

- BS, Saint Joseph’s University

Under ASC 810, Consolidation, a reporting entity (the entity that issues the financial statements) is required to consolidate a separate legal entity when the reporting entity maintains a controlling financial interest in that entity. For many entities, owning more than 50 percent of a legal entity’s voting equity represents a controlling financial interest. However, certain legal entities are not controlled through the voting rights of their equity interests, but through other rights.

To accommodate these differences, U.S. GAAP presents two consolidation models to evaluate whether a reporting entity has a controlling financial interest in a separate legal entity: the variable interest entity model and the voting interest entity model. All reporting entities should first consider whether another legal entity should be consolidated under the variable interest entity (VIE) model and, if the VIE model does not apply, should then consider whether to consolidate the legal entity under the voting interest entity model.

Grant Thornton’s New Developments Summary 2017-03 outlines a step-by-step approach to applying the variable interest entity model to a legal entity to determine whether the reporting entity owns a controlling financial interest in that legal entity and should therefore consolidate the legal entity under the VIE model.

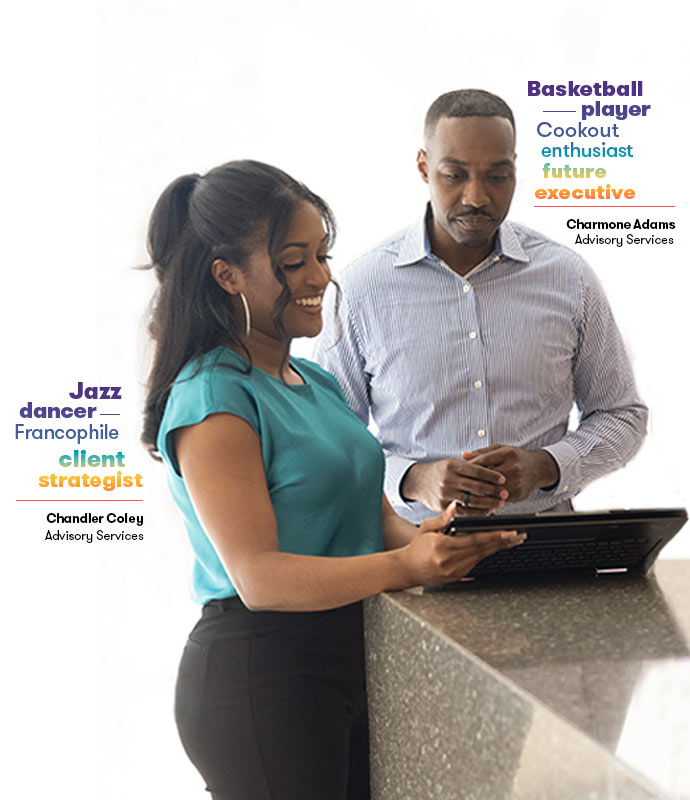

Here, how we work matters

Forget what you expect from a career in professional services. At Grant Thornton, we invite you to bring your own self—empowering you with the flexibility, support and opportunities from day one.

Events

More new developments

No Results Found. Please search again using different keywords and/or filters.

BYOSelf to our careers

With jobs for military veterans, students, experienced professionals and beyond, we have career opportunities that fit the path you're on.

Chandler Coley, a young female professional who works in Advisory Services, and Charmone Adams, a male partner who works in Advisory Services, stand looking over a tablet together. To Chandler’s left are some words that describe how she brings her unique self to Grant Thornton: jazz dancer, Francophile and client strategist. To Charmone’s right are the words basketball player, cookout enthusiast and future executive.

-

Healthcare

-

Manufacturing

-

Technology

-

Banking

-

Nonprofit

A crossroads for healthcare

The new administration will impact the direction of healthcare, which faces significant disruption and the need to stay ahead of emerging challenges.

Reshaping and re-envisioning operations

The manufacturing sector has fueled much of the economic growth of the past eight years, only to be hit hard by COVID-19. A new government could mark a turning point for American manufacturers.

New horizons for technology

Technology, which always operates ahead of the curve, was critical to the election and will play a prominent role going forward.

Dividends of digital transformation

Banks today are focusing on performance and innovation, contemplating how to fast-track digital transformation and navigate this new landscape.

Preparing to embrace the future

COVID-19 has exposed not-for-profit organizations to threats at the moment when those institutions are most vital to communities. The new administration likely will decide which course not-for-profits should chart.

-

Leasing

-

Asset Management

-

Retail

-

Healthcare

-

Telecom

Problem

A car maker’s lease program needed a more efficient way to track, report and process the right property tax payments on behalf of their customers.

Solution

Our alyx platform combined property tax and digital specialists with technology to digitize, analyze and classify tax data for 75% faster compliance and 25% quicker customer service.

![]()

Problem

An investment firm was spending weeks to prepare the documents required for every audit, bridging disconnected systems with manual processes.

Solution

Our alyx platform matched auditors with the right tech and training to develop automated workflows that took the firm’s raw data, reducing the firm’s prep time by 80%.

![]()

Problem

A retailer was collecting data from more than 1,000 locations, manually reconciling and testing various data formats and conventions.

Solution

Our alyx platform matched our team with an automation solution that reconciled and tested the data in 90% less time.

![]()

Problem

In the midst of the COVID-19 pandemic, a healthcare provider needed to quickly process masses of decentralized data in order to file for a tax deduction in the latest regulatory changes.

Solution

Our alyx platform provided our team with the automated data collection and processing to do it swiftly and easily – by our client’s filing deadline.

![]()

Problem

A telecom provider needed to standardize and accelerate the controls in its finance department to reduce external audit risks.

Solution

Our team broke through siloes and streamlined processes, using our alyx platform to replace the repetitive work, apply RPA, and clear out backlogs.

![]()

Share with your network

Share